“He also implied a greater push to cross-sell Finacle into Infosys’ existing banking client base”. “Sikka did say he will double his investment in Finacle,” said Stormonth, adding that the investment could include adding functionalities around its “mobile banking and wealth management”. Some experts, including Rachael Stormonth, senior vice president at Nelson Hall, believe that Infosys may look at expanding Finacle brand to include insurance, something which Mumbai-based TCS has done with its core banking product BaNCS.

#Finacle software free download upgrade

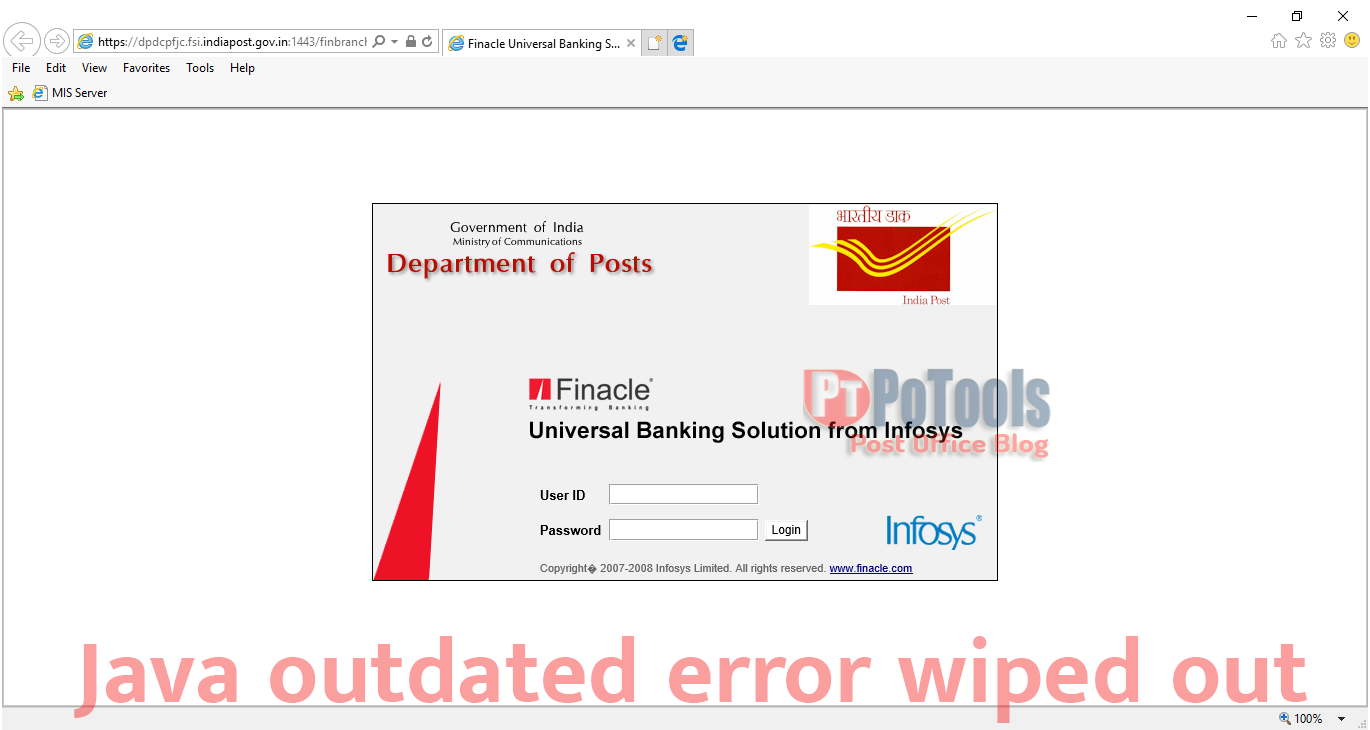

Bank software finacle upgrade#įinacle Deployment and Upgrade Solutionįinacle is a Core Banking Solution that enables banks with digital banking functionalities.Robotic Process Automation powered with Artificial Intelligence. The software product, written in Java, C/C++, was released in the year 1999 (Stable version released in 2000). Finacle is widely used by banks across 100 countries, serves over 1.05 billion customers and 1.3 billion accounts. It is the platform of choice for well-established financial institutions, financial technology organizations (Fintech), digital-only banks, and, non-financial companies. Today’s banking customers consume innovation and personalized products as well as services. Finacle software supports banks to take new banking products to market in quick time. It can be leveraged by various types of banks including micro-finance institutions, private & public sector banks, co-operative banks, fintech companies and non-banking providers. Product Factoryġ000+ parameters and reusable business rules to configure banking products and services. More Power to customersĬustomer-led design and customized products and services on digital channels. Third-party products configurationįlexibility for banks to set up rule-based third-party products Products bundles configurationīundle variety of products and services to enable right-sell Ultra-Modern Digital Platform Templates-driven to create new products, modify existing ones, and rapid deployment of new products. The rapid pace in technology adoption is transforming banks. Finacle supports to embrace digital-driven growth with its ultra-modern digital platform. Optimal Mix of ComponentizationĬomponentized structure and API based integration of components. Open APIsĮxtended RESTful API for co-innovation with the external ecosystem. Production, development and testing across private, hybrid and public cloud.

It runs on a number of technology platforms such as IBM, Oracle, Intel, HP, Unix, Linux and mainframe. It offers complete stack of open source technologies such as JBOSS app server, RHEL, JBPM, Drools, and Enterprise DB.

Processes and posts transactions in real-time on own and third-party channels of origination. Proven availability and performance in both simulated and live client environments. ExtensibilityĮxtends the platform using a set of GUI based tools without changing the base product source code. Multi-entity, multi-currency, multilingual, multi-time zone capabilities to support multinational operations. Modern SecurityĪpplication-level security capabilities include identity and access management, user role management, limits, and exception management. How banks reduce operational costs with Finacle?ĭuring the pandemic, banks were under constant pressure to reduce operational costs.

0 kommentar(er)

0 kommentar(er)